Contents

- Introduction

- The Community Infrastructure Levy

- Viability Evidence and Proposed CIL Charges

- CIL liability

- CIL exemptions

- Calculating the chargeable amount

- Netting off existing floor space

- Liability for CIL

- Payment of CIL

- Payments in kind

- Collection of CIL

- CIL Collection Process

- Appeals

- Spending and reporting on CIL revenue

- Administration fee

- CIL and Section 106 agreements

- Annex 1 - Guide to Use class Order definitions

- Annex 2 - Schedule 1 of the Community Infrastructure Levy Regulations (As amended)

- Annex 3 - How to measure Gross Internal Area

- Annex 4 – Instalments policy

- Annex 5 - Discretionary Exceptional Circumstances Relief Policy

Introduction

1. In 2010, the Government introduced the Community Infrastructure Levy (CIL) as the preferred mechanism for securing developer contributions towards infrastructure to support growth in an area.

2. The City Council was a front-runner in adopting its current CIL Charging Schedule in October 2013, but it is important that the CIL charges are reviewed to ensure that the Council is maximising funding towards infrastructure.

3. The City Council is also in the process of producing the Local Plan 2040. It is therefore prudent to review the Charging Schedule at the current time so that it can be demonstrated how the Charging Schedule will support delivery of the Local Plan 2040.

4. New viability evidence has been produced to support a review of the Charging Schedule and provide evidence for the Local Plan 2040 to support the proposed rates following the CIL consultation.

5. The City Council is a charging authority under CIL legislation and went out to consultation on this Draft Charging Schedule with a view to adopting the new schedule in 2024/5. The consultation took place from Friday 10 November 2023 to Friday 5 January 2024 and again, for the statement of modifications in February/March 2025.

6. In line with the updated evidence and having taken into consideration the content of the representations raised at consultation, partial amendments to the existing CIL Charging Schedule are published for examination.

7. The Draft Charging Schedule is supported by the following evidence documents, which can be found on the Council’s website:

- The Infrastructure Delivery Plan (IDP) which sets out infrastructure requirements to support the delivery of the Local Plan 2040.

- An Infrastructure Funding Gap Statement – demonstrating that a considerable infrastructure gap remains, and CIL funding is still highly desirable for Oxford in addition to other funding sources.

- The Infrastructure Funding Statement 2021/2022, which includes the list of Infrastructure Projects which CIL is intended to fund partly or in full.

- The Oxford City Council: Local Plan Viability Assessment has been undertaken by consultants (BNP Paribas) and is a critical piece of evidence to assist in determining the most appropriate level for the CIL tariff. It considers the viability of development against the costs placed upon new development through the Local Plan 2040’s policies and the application of CIL.

- The Oxford CIL Offices and R&D Viability Addendum note was produced following consultation to consider additional site-specific testing of the R&D and Offices rates.

The Community Infrastructure Levy

8. Oxford City Council is the charging authority for the purpose of Part 11 of the Planning Act 2008 and the CIL Regulations 2010 (as amended).

9. The Community Infrastructure Levy is a tariff in the form of a standard charge on new development, which in Oxford is set by the City Council to help the funding of infrastructure. It is intended to supplement, or top up, other sources of funding to widen infrastructure delivery.

10. Most development has some impact on infrastructure and should contribute to the cost of providing or improving infrastructure. The principle behind CIL is for those who benefit financially from a planning permission to pay towards the cost of funding the infrastructure needed to support development.

11. CIL will improve Oxford City Council’s ability to mitigate the cumulative impacts on infrastructure from most developments as it is charged on a per square metre basis and is proportional to the scale of the development.

12. In investing in the infrastructure of the area, CIL is expected to have a positive economic effect on development in the medium to long term.

13. The City Council must set CIL rates in a Charging Schedule and can implement these, after taking a consultation and an Examination in Public followed by adoption. Following the 2019 amendments to the CIL regulations, the requirement for a preliminary draft charging schedule and consultation has been removed.

14. Regulation 14 of the CIL regulations (as amended) state that when setting CIL rates, the Council must strike an appropriate balance between the desirability to fund infrastructure through CIL and the potential effect (taken as a whole) of the levy on the economic viability of development in the area where CIL charges apply. When considering infrastructure costs, the Council needs to estimate the cost of infrastructure to support development and take into account other sources of funding.

CIL Regulations 2010 (as amended), Part 3, Regulation 14:

‘14.—(1) In setting rates (including differential rates) in a charging schedule, a charging authority must strike an appropriate balance between—

(a) the desirability of funding from CIL (in whole or in part) the actual and expected estimated total cost of infrastructure required to support the development of its area, taking into account other actual and expected sources of funding; and

(b) the potential effects (taken as a whole) of the imposition of CIL on the economic viability of development across its area.

(2) In setting rates in a charging schedule, a charging authority may also have regard to actual and expected administrative expenses in connection with CIL to the extent that those expenses can be funded from CIL in accordance with regulation 61…’

15. Regulation 13 of the CIL Regulations 2010 (as amended) makes provision for the setting of differential rates for different geographical areas, different development types/uses, and development size or a combination of them. Any differential rate should be justified by economic viability evidence.

16. The term ‘taken as a whole’ indicates that economic viability evidence is used to show that CIL rates can be borne by most development across Oxford. It does not mean that CIL rates can be borne by each and every development. The City Council has used evidence in the Oxford City Council: Local Plan Viability Assessment to inform appropriate CIL rates.

17. Infrastructure and economic viability evidence supporting the Draft Charging Schedule illustrates that an appropriate balance between funding infrastructure and economic viability has been sought.

Viability Evidence and Proposed CIL Charges

18. The Oxford City Council: Local Plan Viability Assessment assesses the economic viability of development in Oxford. To consider setting CIL rates for different types of development, the Study considers the cumulative application of policies in the Local Plan 2040 on different development typologies and then considers the ability of each development type to support additional CIL rates.

19. Following consultation, an additional addendum note was produced to consider comments made at consultation of the partial review of the charging schedule.

20. The evidence gathered in the original and supplementary viability work supports an increase in Class E - Office and R&D rates, demonstrating from site-specific testing that surpluses from key employment sites can accommodate an increase in this rate.

21. Although original viability testing showed that Class B developments can accommodate an increased CIL rate, following the approval of a recent major industrial development, there is currently no known Class B floorspace anticipated to come forth, meaning that additional site-specific testing could not be carried out.

22. The proposed changes to the adopted charging schedule are thus to increase E - Office and R&D rates, and to maintain B2/B8 industrial rates at their current rate.

23. As these are the only changes being proposed, the Council intends for the rest of the charging schedule to remain as it is and for this review to be considered a partial review.

24. If and where issues of viability or economic impact may arise, the exceptional circumstances relief policy introduced in 2019 can be considered to mitigate risk of delivery of sites on a case-by-case basis (Annex 5).

25. The proposed CIL rates in pounds sterling per square metre according to the type of development are shown on our Community Infrastructure Levy rates page.

CIL liability

26. Development liable for CIL payment comprises:

- Development that creates 100m2 or more of new build floor space measured as Gross Internal Floor Area (GIA).

- Development of less than 100m2 new build GIA that results in the creation of one or more dwellings.

- The conversion of a building that is no longer in lawful use.

27. Liability to pay CIL on qualifying developments applies whether development requires planning permission or is enabled through permitted development orders (General Permitted Development Order, Local Development Orders, Neighbourhood Development Orders, Enterprise Zones)[footnote 1]

CIL exemptions

28. CIL charges will not be levied on:

- Development that creates less than 100m2 of new build floor space measured as GIA and does not result in the creation of one or more dwellings;

- Buildings into which people do not normally go, or a building into which people go only intermittently for the purpose of inspecting or maintaining fixed plant or machinery;[footnote 2]

- Buildings for which planning permission was granted for a limited period.

- Affordable housing, subject to an application by a landowner for CIL relief (CIL regulation 49);

- Development by charities for charitable purposes subject to an application by a charity landowner for CIL relief (CIL regulation 43) (mandatory charitable relief);

- Self-build (CIL regulation 42A and 54A).[footnote 3]

29. A charging authority can choose to offer discretionary relief to a charity landowner where the greater part of the chargeable development will be held as an investment, from which the profits are applied for charitable purposes (CIL regulation 44).

30. It can also choose to offer exceptional circumstances relief (CIL regulation 55) on the basis of an unacceptable impact on the economic viability of a development, and where the exemption of a charitable institution from liability to pay CIL would constitute State aid (CIL regulation 45) and would otherwise be exempt from liability under regulation 43.

31. In Oxford City discretionary charity relief is not available (CIL regulation 44). However, a Discretionary Exceptional Circumstances Relief Policy (CIL regulation 55) is available. (Annex 5)

Calculating the chargeable amount

32. The City Council will calculate the amount of CIL chargeable in accordance with regulation 40 of the Community Infrastructure Levy (as amended) Refer to Annex 2 for an extract of this regulation.

33. The relevant rate (R) for each development type is shown in the Charging Schedule above and the Gross Internal Area (GIA) is measured and calculated in accordance with the Royal Institute of Chartered Surveyors (RICS) Code of Measuring Practice. Annex 3 sets out an extract of RICS code.

34. The chargeable amount will reflect inflation by being index linked to RICS’ Building Cost Information Service ‘CIL Index’.

35. Amended CIL Regulations mean that for Section 73 applications to vary an existing planning condition, CIL will only be payable upon any increase in chargeable floorspace from the section 73 application/permission[footnote 3].

Netting off existing floor space

36. In certain circumstances, where a development includes the demolition of an existing building, the existing Gross Internal Area (GIA) can be deducted from the proposed floorspace. These deductions in respect of demolition or change of use will only apply where the existing building has been in continuous lawful use[footnote 4] for at least six months in the 3 years prior to the development being permitted and is still in situ on the day planning permission is granted.

37. Oxford City Council may deem the Gross Internal Area (GIA) of a building to be zero where there is not sufficient information, or no information of sufficient quality, regarding the GIA of an existing building or whether it is in lawful use.

Liability for CIL

38. Once planning permission is granted, CIL regulations encourage any party, (such as a developer submitting a planning application, or a landowner), to take liability to pay the CIL charge. CIL liability runs with the land. If no party assumes liability to pay before development commences, land-owners will be liable to pay the levy.

Payment of CIL

39. The default position is that CIL payment is due within 60 days of the commencement of development; however in some cases CIL is due immediately.[footnote 5] For some developments, instalments may be permitted in accordance with the City Council’s Instalments policy. Annex 4 of this document sets out an Instalments Policy.

Payments in kind

40. In circumstances where the liable party and Oxford City Council agree, payment of the levy may be made by transferring land. The agreement cannot form part of a planning obligation, must be entered into before the chargeable development is commenced[footnote 6] and is subject to fulfilling the following:

- the acquired land is used to provide or facilitate the provision of infrastructure within Oxford;

- the land is acquired by Oxford City Council or a person nominated by Oxford City Council;

- the transfer of the land must be from a person who has assumed liability to pay CIL;

- the land has to be valued by an independent person agreed by Oxford City Council and the person liable to pay CIL;

- ‘Land’ includes existing buildings and other structures, land covered with water, and any estate, interest, easement, servitude or right in or over the land.

Collection of CIL

41. Oxford City Council is the collecting authority for the purpose of Part 11 of the Planning Act 2008 and CIL Regulations 2010 (as amended).

42. When planning permission is granted, Oxford City Council will issue a liability notice setting out the amount payable, and the payment procedure.

43. In the case of development enabled through permitted development orders, the person(s) liable to pay will need to consider whether their proposed development is chargeable, and to issue Oxford City Council a notice of chargeable development.

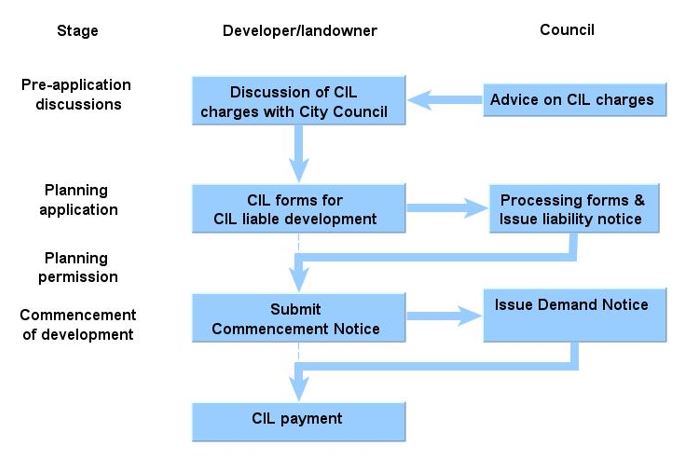

44. The diagram below illustrates a summarised version of the collection process:

CIL Collection Process

Plain text version

Stage 1 - Pre-application discussions

- Developer/landowner - Discussion of CIL charges with City Council

- Council - Advice on CIL charges

Go to Stage 2.

Stage 2 - Planning application

- Developer/landowner - CIL forms for CIL liable development

- Council - Processing forms and issue liability notice

Go to Stage 3.

Stage 3 - Planning permisson

Go to Stage 4.

Stage 4 - Commencement of development

- Developer/landowner - Submit Commencement Notice

- Council - Issue Demand Notice

Go to Stage 5

Stage 5 - CIL payment

- Developer/landowner - CIL payment

End of flowchart.

Appeals

45. A liable person can request a review of the chargeable amount by the charging authority within 28 days from the issue of the liability notice. CIL Regulations allow for appeals on:

- The calculation of the chargeable amount following a review of the calculation by the City Council.

- Disagreement with the City Council’s apportioned liability to pay the charge.

- Any surcharges incurred on the basis that they were calculated incorrectly, or that a liability notice was not served or the breach did not occur.

- A deemed commencement date if considered that the date has been determined incorrectly.

- Against a stop notice if a warning notice was not issued or the development has not yet commenced.

46. A person aggrieved by the levy (or attempt to levy), a distress may appeal to the Magistrates Court (regulation 99).

Spending and reporting on CIL revenue

47. CIL revenue will be spent on the infrastructure needed to support development in Oxford. Oxford City Council will publish on its website a list of infrastructure projects or types of infrastructure that may be wholly or partly funded by the levy. This list for CIL expenditure is set out each year in the Council’s Infrastructure Funding Statement, and the full infrastructure list for Oxford City is set out in the Infrastructure Delivery Plan.

48. Oxford City Council will publish an annual Infrastructure Funding Statement, for each financial year including:

- How much has been collected in CIL and S106 contributions;

- How much has been spent;

- The infrastructure on which it has been spent;

- Any amount used to repay borrowed money;

- Amount of CIL retained at the end of the reported year.

49. It is the Government’s intention to allow for a proportion of CIL to be passed to Parish Councils and Neighbourhoods[footnote 7]. 15% of CIL receipts in parished areas are to be passed to the relevant Parish Council. In unparished areas, this 15% would be held by the City Council and spent in consultation with the community. The proportion would rise to 25% in areas with adopted Neighbourhood Plans.

Administration fee

50. Oxford City Council will use 5% of the CIL revenue to fund the administration costs of the Levy.

CIL and Section 106 agreements

51. Unlike Section 106 (S106), the levy is to provide infrastructure to support the development of an area, not to make individual planning applications acceptable in planning terms. It breaks the link between a specific development site and the provision of infrastructure and thus provides greater flexibility for delivery of infrastructure when and where it is needed.

52. Section 106 agreements and Section 278 Highways Agreements will continue to be used to secure site-specific mitigation and affordable housing. In some instances, S106 agreements may be used in strategic development sites needing the provision of their own specific infrastructure for which delivery may be more suitably dealt with through S106s.

53. Following removal of the regulation 123 list, the amended CIL regulations no longer contain a restriction on the pooling of funds from more than five S106 obligations to fund a single infrastructure project and both CIL and S106 funding can be secured towards the same piece of infrastructure.

Annex 1 - Guide to Use class Order definitions

The following list is based on the Government’s guide to Use Classes as shown in their planning and building regulations online resource ‘The Planning Portal’. It is not a definitive source of legal information.

Class B

- B2 General industrial - Use for industrial process other than one falling within class E(g) (previously class B1) (excluding incineration purposes, chemical treatment or landfill or hazardous waste)

- B8 Storage or distribution - This class includes open air storage.

Class C

- C1 Hotels - Hotels, boarding and guest houses where no significant element of care is provided (excludes hostels)

- C2 Residential institutions - Residential care homes, hospitals, nursing homes, boarding schools, residential colleges and training centres

- C2A Secure Residential Institution - Use for a provision of secure residential accommodation, including use as a prison, young offenders institution, detention centre, secure training centre, custody centre, short term holding centre, secure hospital, secure local authority accommodation or use as a military barracks

- C3 Dwellinghouses - This class is formed of three parts

- C3(a) covers use by a single person or a family (a couple whether married or not, a person related to one another with members of the family of one of the couple to be treated as members of the family of the other), an employer and certain domestic employees (such as an au pair, nanny, nurse, governess, servant, chauffeur, gardener, secretary and personal assistant), a carer and the person receiving the care and a foster parent and foster child

- C3(b) covers up to six people living together as a single household and receiving care e.g. supported housing schemes such as those for people with learning disabilities or mental health problems

- C3(c) allows for groups of people (up to six) living together as a single household. This allows for those groupings that do not fall within the C4 HMO definition, but which fell within the previous C3 use class, to be provided for i.e. a small religious community may fall into this section as could a homeowner who is living with a lodger

- C4 Houses in multiple occupation - Small shared houses occupied by between three and six unrelated individuals, as their only or main residence, who share basic amenities such as a kitchen or bathroom.

Class E – Commercial, Business and Service

- In 11 parts, Class E more broadly covers uses previously defined in the revoked Classes A1/2/3, B1, D1(a-b) and ‘indoor sport’ from D2(e):

- E(a) Display or retail sale of goods, other than hot food

- E(b) Sale of food and drink for consumption (mostly) on the premises

- E(c) Provision of:

- E(c)(i) Financial services,

- E(c)(ii) Professional services (other than health or medical services), or

- E(c)(iii) Other appropriate services in a commercial, business or service locality

- E(d) Indoor sport, recreation or fitness (not involving motorised vehicles or firearms or use as a swimming pool or skating rink,)

- E(e) Provision of medical or health services (except the use of premises attached to the residence of the consultant or practitioner)

- E(f) Creche, day nursery or day centre (not including a residential use)

- E(g) Uses which can be carried out in a residential area without detriment to its amenity:

- E(g)(i) Offices to carry out any operational or administrative functions,

- E(g)(ii) Research and development of products or processes

- E(g)(iii) Industrial processes

Class F - Local Community and Learning

- In two main parts, Class F covers uses previously defined in the revoked classes D1, ‘outdoor sport’, ‘swimming pools’ and ‘skating rinks’ from D2(e), as well as newly defined local community uses.

- F1 Learning and non-residential institutions – Use (not including residential use) defined in 7 parts:

- F1(a) Provision of education

- F1(b) Display of works of art (otherwise than for sale or hire)

- F1(c) Museums

- F1(d) Public libraries or public reading rooms

- F1(e) Public halls or exhibition halls

- F1(f) Public worship or religious instruction (or in connection with such use)

- F1(g) Law courts

- F2 Local community – Use as defined in 4 parts:

- F2(a) Shops (mostly) selling essential goods, including food, where the shop’s premises do not exceed 280 square metres and there is no other such facility within 1000 metres

- F2(b) Halls or meeting places for the principal use of the local community

- F2(c) Areas or places for outdoor sport or recreation (not involving motorised vehicles or firearms)

- F2(d) Indoor or outdoor swimming pools or skating rinks

Sui Generis

- 'Sui generis' is a Latin term that, in this context, means ‘in a class of its own’.

- Certain uses are specifically defined and excluded from classification by legislation, and therefore become ‘sui generis’. These are:

- theatres

- amusement arcades/centres or funfairs

- launderettes

- fuel stations

- hiring, selling and/or displaying motor vehicles

- taxi businesses

- scrap yards, or a yard for the storage/distribution of minerals and/or the breaking of motor vehicles

- ‘Alkali work’ (any work registerable under the Alkali, etc. Works Regulation Act 1906 (as amended))

- hostels (providing no significant element of care)

- waste disposal installations for the incineration, chemical treatment or landfill of hazardous waste

- retail warehouse clubs

- nightclubs

- casinos

- betting offices/shops

- pay day loan shops

- public houses, wine bars, or drinking establishments – from 1 September 2020, previously Class A4

- drinking establishments with expanded food provision – from 1 September 2020, previously Class A4

- hot food takeaways (for the sale of hot food where consumption of that food is mostly undertaken off the premises) – from 1 September 2020, previously Class A5

- venues for live music performance – newly defined as ‘Sui Generis’ use from 1 September 2020

- cinemas – from 1 September 2020, previously Class D2(a)

- concert halls – from 1 September 2020, previously Class D2(b)

- bingo halls – from 1 September 2020, previously Class D2(c)

- dance halls – from 1 September 2020, previously Class D2(d)

- Other uses become ‘sui generis’ where they fall outside the defined limits of any other use class.

- For example, C4 (Houses in multiple occupation) is limited to houses with no more than six residents. Therefore, houses in multiple occupation with more than six residents become a ‘sui generis’ use.

Source: Planning Portal

Annex 2 - Schedule 1 of the Community Infrastructure Levy Regulations (As amended)

CHARGEABLE AMOUNT – Part 1 – Standard Cases

Calculation of chargeable amount

(1) The collecting authority must calculate the amount of CIL payable (“chargeable amount”) in respect of a chargeable development in accordance with this regulation.

(2) The chargeable amount is an amount equal to the aggregate of the amounts of CIL chargeable at each of the relevant rates.

(3) But where that amount is less than £50 the chargeable amount is deemed to be zero.

(4) The relevant rates are the rates, taken from the relevant charging schedules, at which CIL is chargeable in respect of the chargeable development.

(5) The amount of CIL chargeable at a given relevant rate (R) must be calculated by applying the following formula—

where—

A = the deemed net area chargeable at rate R, calculated in accordance with paragraph (7);

IP = the index figure for the year in which planning permission was granted; and

IC = the index figure for the year in which the charging schedule containing rate R took effect.

(6) In this regulation the index figure for a given year is -

(a) the figure for 1st November for the preceding year in the RICS CIL Index published from time to time by the Building Cost Information Service of the Royal Institution of Chartered Surveyors (1); or

(b) if the RICS CIL Index ceases to be published, the figure for 1st November for the preceding year in the retail prices index.

(7) The value of A must be calculated by applying the following formula—

where—

G = the gross internal area of the chargeable development;

GR = the gross internal area of the part of the chargeable development chargeable at rate R;

KR = the aggregate of the gross internal areas of the following—

(i) retained parts of in-use buildings, and

(ii) for other relevant buildings, retained parts where the intended use following completion of the chargeable development is a use that is able to be carried on lawfully and permanently without further planning permission in that part on the day before planning permission first permits the chargeable development;

E = the aggregate of the following—

(i) the gross internal areas of parts of in-use buildings that are to be demolished before completion of the chargeable development, and

(ii) for the second and subsequent phases of a phased planning permission, the value Ex (as determined under paragraph (8)), unless Ex is negative, provided that no part of any building may be taken into account under both of paragraphs (i) and (ii) above.

(8) The value Ex must be calculated by applying the following formula—

EP – (GP – KPR)

where—

EP = the value of E for the previously commenced phase of the planning permission;

GP = the value of G for the previously commenced phase of the planning permission; and

KPR = the total of the values of KR for the previously commenced phase of the planning permission.

(9) Where a collecting authority does not have sufficient information, or information of sufficient quality, to enable it to establish that a relevant building is an in-use building, it may deem it not to be an in-use building.

(10) Where a collecting authority does not have sufficient information, or information of sufficient quality, to enable it to establish—

(a) whether part of a building falls within a description in the definitions of KR and E in paragraph (7); or

(b) the gross internal area of any part of a building falling within such a description, it may deem the gross internal area of the part in question to be zero.

(11) In this regulation—

“building” does not include—

(i) a building into which people do not normally go,

(ii) a building into which people go only intermittently for the purpose of maintaining or inspecting machinery, or

(iii) a building for which planning permission was granted for a limited period;

“in-use building” means a building which—

(i) is a relevant building, and

(ii) contains a part that has been in lawful use for a continuous period of at least six months within the period of three years ending on the day planning permission first permits the chargeable development;

“new build” means that part of the chargeable development which will comprise new buildings and enlargements to existing buildings;

“relevant building” means a building which is situated on the relevant land on the day planning permission first permits the chargeable development;

“relevant charging schedules” means the charging schedules which are in effect—

(i) at the time planning permission first permits the chargeable development, and

(ii) in the area in which the chargeable development will be situated;

“retained part” means part of a building which will be—

(i) on the relevant land on completion of the chargeable development (excluding new build),

(ii) part of the chargeable development on completion, and

(iii) chargeable at rate R.”

(1) Registered in England and Wales RC00487.

Annex 3 - How to measure Gross Internal Area

Oxford City Council will use the Royal Institution of Chartered Surveyors (RICS)’s Code of Measuring Practice to measure or check the Gross Internal Area (GIA) of a development and calculate or confirm its relevant CIL rate. The guide below is based on RICS’ Code of Measuring Practice (6th edition, with amendments), the full Code of Measuring Practice is available in RICS website.

GIA is the area of a building measured to the internal face of the perimeter walls at each floor level.

Including:

- Areas occupied by internal walls and partitions

- Columns, piers, chimney breasts, stairwells, lift-wells, other internal projections, vertical ducts, and the like

- Atria and entrance halls, with clear height above, measured at base level only

- Internal open-sided balconies, walkways, and the like

- Structural, raked or stepped floors are property to be treated as a level floor measured horizontally

- Horizontal floors, with permanent access, below structural, raked or stepped floors

- Corridors of a permanent essential nature (e.g. fire corridors, smoke lobbies)

- Mezzanine floor areas with permanent access

- Lift rooms, plant rooms, fuel stores, tank rooms which are housed in a covered structure of a permanent nature, whether or not above the main roof level

- Service accommodation such as toilets, toilet lobbies, bathrooms, showers, changing rooms, cleaners’ rooms, and the like

- Projection rooms

- Voids over stairwells and lift shafts on upper floors

- Loading bays

- Areas with a headroom of less than 1.5m*

- Pavement vaults

- Garages

- Conservatories

Excluding:

- Perimeter wall thicknesses and external projections

- External open-sided balconies, covered ways and fire escapes

- Canopies

- Voids over or under structural, raked or stepped floors

- Greenhouses, garden stores, fuel stores, and the like in residential

* GIA is the basis of measurement in England and Wales for the rating of industrial buildings, warehouses, retail warehouses, department stores, variety stores, food superstores and many specialist classes valued by reference to building cost (areas with a headroom of less than 1.5m being excluded except under stairs)

Annex 4 – Instalments policy

Community Infrastructure Levy Installments Policy

a) This policy is made in line with regulation 69B of the Community Infrastructure Levy (As amended). Oxford City Council will allow the payment of CIL as outlined in points 1 and 2 below:

b) Where the chargeable amount is less than £200,000 the chargeable amount will be required within 60 days of commencement.

c) Where the chargeable amount is between £200,000 and £2 million, the chargeable amount will be required as per the following four instalments:

- 1st instalment - 25% within 60 days

- 2nd instalment - 25% within 160 days

- 3rd instalment - 25% within 260 days

- 4th instalment - 25% within 360 days

Where the chargeable amount is over £2 million, the chargeable amount will be required as per the following four instalments:

- 1st instalment - 25% within 60 days

- 2nd instalment - 25% By end of year 1

- 3rd instalment - 25% By end of year 2

- 4th instalment - 25% By end of year 3

d) Commencement will be taken to be the date advised by the developer in the commencement notice under CIL regulation 67.

e) Notes:

f) N1: When the City Council grants an outline planning permission which permits development to be implemented in phases, each phase of development is a separate chargeable development and the instalment policy will apply to each separate phase.

g) N2: This policy will not apply if:

- A commencement notice is not submitted prior to commencement of the chargeable development

- Nobody has assumed liability to pay CIL in respect of the chargeable development prior to the intended day of commencement

- Failure to notify the City Council of a disqualifying event before the end of 14 days beginning with the day the disqualifying event occurs

- An instalment payment has not been made in full after the end of the period of 30 days beginning with the day on which the instalment payment was due.

Annex 5 - Discretionary Exceptional Circumstances Relief Policy

See our CIL Discretionary Exceptional Circumstances Relief Policy.

Footnotes

1. Regulations 5 and 9 of the Community Infrastructure Levy Regulations 2010 as amended. Return to where footnote 1 is referenced ↩

2. Regulation 6 (2) of the Community Infrastructure Levy Regulations 2010 as amended. Return to where footnote 2 is referenced ↩

3. Regulation 42A and 54A of the Community Infrastructure Levy (As amended). Return to where footnote 3 is referenced ↩

4. ‘in-use building’ means a building which (i) is a relevant building and (ii) contains a part that has been in use for a continuous period of at least six months within the period of three years ending on the day planning permission first permits the chargeable development’ (Regulation 40(11) of the Community Infrastructure Levy Regulations 2010 (as amended). Return to where footnote 4 is referenced ↩

5. Payments are due immediately where no party assumes liability and/or no commencement notice is submitted before commencement. Where this occurs the developer does not get the benefit of payment by instalments. Return to where footnote 5 is referenced ↩

6. Regulation 73 (6)(d) of the Community Infrastructure Levy Regulations 2010 as amended. Return to where footnote 6 is referenced ↩

7. Set out in Regulation 59A of the Community Infrastructure Levy (As amended). Return to where footnote 7 is referenced ↩